Step 3: Investment Behavioral Assessment

A behavioral assessment is important to identify an investor's propensity to self-sabotage an otherwise sound investment plan. The Investment Synapse takes careful consideration of the psychology and neuroscience of decision making as it relates to investing. This is an area of active and rich research with a myriad of cognitive errors and biases identified that can lead to imprudent investing decisions. Financial practitioners are increasingly devising methods to reduce the ability of these cognitive errors and emotional reactions to negatively impact investment performance. This is called "debiasing" the portfolio. A fuller exploration and profiling of behavioral biases and cognitive errors is pursued in another section.

Fortunately, most biases can be overcome by having a well constructed investment policy that guides rational decision making. But the best policy is only good as far and as long as it is followed. If an investor is prone to abandon a plan at the first market downturn, it serves no purpose. So it is wise to conduct a behavioral assessment for one´s ability to handle adverse events and thus, likelihood to adhere to an investment plan long term.

|

|

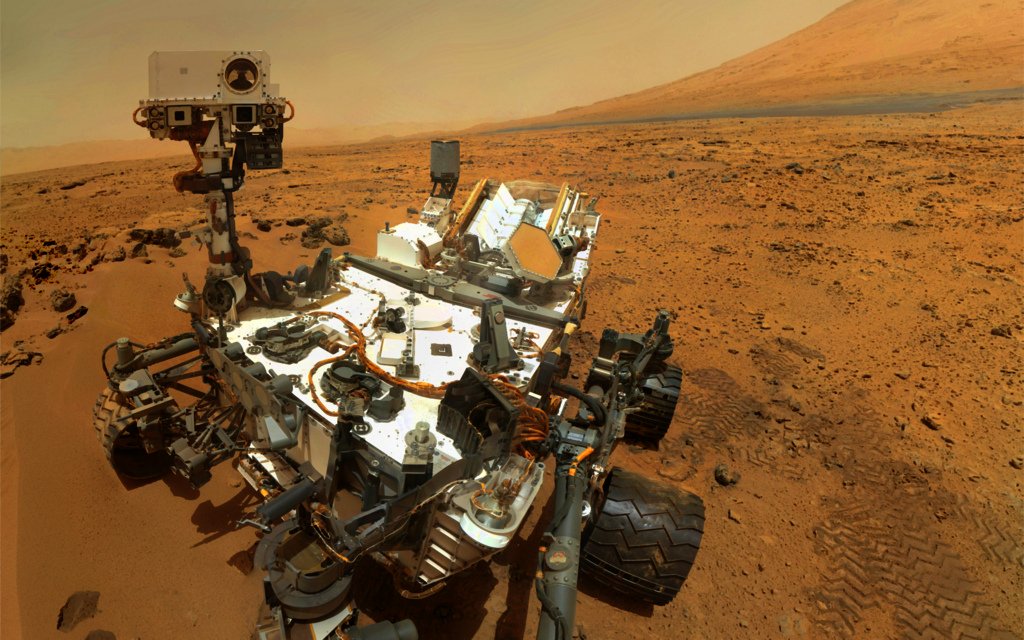

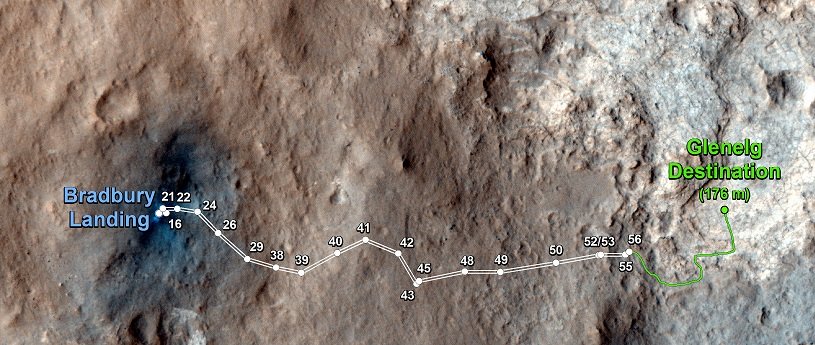

Every step and action of NASA's Mars Curiosity rover must be meticulously planned and rationalized to reach the mission destination. Great efforts are made to minimize the risk of "human error". So, too, your portfolio should be safeguarded against behavioral errors.

These questions are designed as a behavioral assessment of the psychological ability to assume risk in the portfolio and maintain a predetermined plan. They do not cover all the known and documented biases but focus on the more problematic biases that can remain after debiasing. Even if the behavioral assessment suggests an adjustment to the risk budget to a more conservative level, it is possible that with time, an investor will gain confidence in the ability of the investment plan to succeed over time and can adjust the risk budget back upwards. The behavioral assessment should be retaken periodically (such as during the periodic comprehensive review).

Behavioral assessment: Question 1

In your "play money" account, you bought stock in a company you expect to outperform over the long term. Six months later, market sentiment in general weakens and prices across the board fall. You are unsure how much further prices will continue to fall. How do you think you would feel?

a) Fearful of further losses and would probably sell your stock now.

b) Worried but want to give your investment a chance to make a quick come back. You make a decision to sell if the stock falls another 5%.

c) Agitated but you would not sell to avoid taking a loss. However, you would probably be checking your investment more frequently.

d) Concerned or sanguine but would remind yourself market corrections are normal and you are invested for the long-haul and the company's fundamentals are still in tact so you hold your position.

e) Elated that the stock is even more attractive know for the long-term and you scrounge some money together to but more shares.

Behavioral assessment: Question 2

A position in your strategic portfolio has performed very well and outpaced the rest of your portfolio. It is time for your periodic rebalancing which will mean selling some of the position back to its target weight. However, the day before you are set to rebalance you hear a "hot tip" at work that the company should do even better than before over the next year. What do you think you would feel about rebalancing the position back to its target weight:

a) You would have no problem selling some of the position as you understand this is part of a disciplined plan and don't make decisions on gossip, anyway.

b) You would go ahead with the rebalancing but regret it if the position actually does do as well as the gossip suggested.

c) You would hold off on the rebalancing to see if there is any merit to the gossip.

d) You would deviate from your investment plan and add to the position, overweighting the position to a larger extent.

Behavioral assessment: Question 3

Consider the following two sub-questions and answer independently.

Q1) You have $500,000 in cash and need to create a portfolio that will generate income while you pursue an advanced degree. Your grandfather, a survivor of the Great Depression, urges you to buy gold. Your advisor presents a diversified portfolio of municipal bonds, bank CDs and dividend paying blue chip stocks. He advises against adding gold to your portfolio as this will not generate income. Your response would be closest to which of the following:

a) Agree to the purchase of bonds, CDs and dividend stocks with the full $500,000. A position in gold does not match your portfolio goals.

b) Agree to purchase bonds, CDs and dividend stocks with $400,000 but instruct your advisor to also purchase $100,000 in gold.

Q2) You have $400,000 in cash and need to create a portfolio that will generate income while you pursue an advanced degree. You also have $100,000 in gold coins you inherited from your grandfather. Your advisor presents a diversified portfolio of municipal bonds, bank CDs and dividend paying blue chip stocks. He advises selling the gold to add to your portfolio in order to ensure your income needs can be met. Your response would be closest to which of the following:

c) Agree to the purchase of bonds, CDs and dividend stocks and the sale of the gold. A position in gold does not match your portfolio goals and without the additional funds, your income could be at risk.

d) Agree to purchase bonds, CDs and dividend stocks with $400,000 but do not sell the gold coins, understanding your portfolio will be underfunded.

Behavioral assessment: Question 4

You are the sales executive for a small, successful tech company, selling patient tracking software applications to medical institutions. You are doing well in the company and feel there is tremendous growth potential in the industry. Your financial advisor comes to you with an asset allocation for your long-term investment plan based on aggregated analysis of all sectors of the market. How are you are most likely to respond?

a) Ask your advisor to increase the portfolio to exposure to the tech and health care sectors, even if it means eliminating other options from the portfolio. Additionally, instruct your advisor to buy stock in the companies you are doing business with.

b) Ask your advisor to include additional weights to the tech and health care sector to leverage your expertise, even if it means eliminating other options from the portfolio. But do not include instructions to buy stock in the companies you do business with.

c) Accept your advisors recommendations with no further modifications based on your work experience.

Behavioral assessment: Question 5

You have not been investing but hoarding cash since the last financial crisis. But getting no return on your money has made you think about investing in a balanced portfolio with a 10 year return record of 8%. You invest in the portfolio and 1 year later the return on your investment is only 4%. How are you likely to feel?

a) Unsettled that the portfolio performed below it's long term average, exposing you to the risk of an even greater loss had the year been worse. You would likely sell out of the portfolio at this point feeling investing you money in the market was a mistake.

b) Disappointed in the below-average performance but you would chalk it up to a bad year and stay in the investment for at least another year.

c) Elated that even if the portfolio only returned 4% this particular year, that is 4% more that you would have earned if you had stayed in cash. As long as the portfolio stays up with the overall market or does better, you are confident over the long-term you can achieve a reasonable return for the risk you are taking.

Behavioral assessment: Question 6

You are doing some preparatory work before meeting with your financial advisor to set portfolio expectations. Looking back over the past 5 years, you are excited that a typical investor with your moderate risk tolerance earned 10% per year, on average. However, when you meet with your advisor, he informs you the past 5 years have been an exceptionally strong bull market. Instead, forward looking long-term projections taking into account structural changes underway in monetary policy and a softening economic cycle suggest a return expectation of 7% for your risk tolerance. How are you likely to respond?

a) You accept that 7% is a more reasonable expectation for the long-term and move forward with your planning on that number.

b) You press on keeping the 10% target return, understanding you may need to accept a higher risk level in your portfolio.

c) You insist on keeping the 10% target return you expected but are not willing to incorporate more risk in the portfolio.

Scoring the behavioral assessment

Question 1: If you answered A, B or C, you may be susceptible to the loss aversion bias

Question 2: If you answered B, C or D, you may be susceptible to the regret aversion bias

Question 3: If you answered A and D, you may be susceptible to the endowment effect bias

Question 4: If you answered A or B, you may be susceptible to the overconfidence bias

Question 5: If you answered A or B, you may be susceptible to the framing bias

Question 6: If you answered B or C, you may be susceptible to the anchoring bias

Now what?

Simply being aware of one's biases goes far to minimize their impact. If you remain cognizant of the cognitive traps that awaits the human brain, you are less likely to deviate from plan. Most important of all is to have a written Investment Policy Statement that you understand, believe in and are committed to following.

Having identified the susceptibility towards behavioral biases, there are two main remedies:

1) Engage a financial advisor who is versed in the biases revealed in the behavioral assessment and can be the "voice of reason" when needed.

2) If necessary, modify the risk level of the portfolio down to reduce the likelihood of abandoning the investment plan in stressful times.

Don't second guess your investment plan when the heat is on! Have set times to review and modify the plan during calm periods.